October 22, 2009

The love hate relationship with credit cards for many Americans is probably leaning more in the hate stage at the moment. Americans have over $2 trillion in revolving debt – $1 trillion of that is plastic. The average American has come to rely on credit cards as a form of supplemental income, like retirees come to rely on Social Security. You would assume with the Federal Reserve flooding banks with easy money that credit card terms would ease up on consumers. They have not. If anything, terms have gotten more onerous in the last year. Credit card companies are battling with increasing default rates and trying to figure out how to maximize profits. As it turns out, they now have to cannibalize their good customers for their horrid lending practices during the debt bubble.

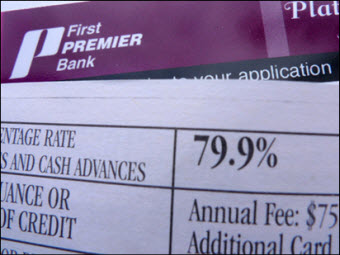

Take for example a report that NBC San Diego did. They found a credit card that was offering a 79.9% annual rate. Not bad enough? They also charge an annual fee:

Source: The Consumerist

Even the recent historic equities rally is in the 60 percent range. Yet these are common tactics. Some more troubling trends are going after customers that pay their bills on time:

“(USA Today) You floss regularly, yield to oncoming traffic and use your credit cards judiciously, dutifully paying off your balance every month.

You may believe that your exemplary behavior shields you from unexpected credit card fees. Sadly, that is no longer the case.

Starting next year, Bank of America will charge a small number of customers an annual fee, ranging from $29 to $99. The bank has characterized the fee as experimental. But card holders who have never carried a balance or paid late fees could be among those affected.”

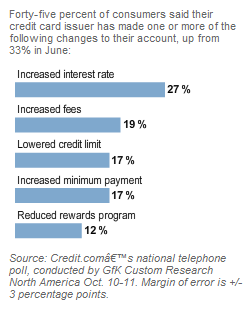

To show you how rampant this is, take a look at changes customers are seeing to their credit cards over the last few months even though the Fed and U.S. Treasury have rescued many of these companies:

Much of this is coming in a hurry trying to beat the 2010 new credit card legislation that will make it harder for credit card companies to milk consumers like nationwide loan sharks. At this point, they can’t squeeze blood out of a turnip or break kneecaps so they are now going after good paying customers since it would seem they are the only folks with money left. Even if you pay off your balance every month, you can expect some credit card companies to start charging an annual fee just for having the account. I would imagine that many accounts that have been open with no usage will also be shut down or have their lines decreased. This has occurred personally to me and I can verify the rate increases as well (nothing like 79.9% however).

So why is this happening right now aside from the legislation? Credit card companies are bleeding money.

No comments:

Post a Comment